how to calculate stock up rate

Interest rate variance range. The dividend growth rate of a stock can be calculated using any period of time.

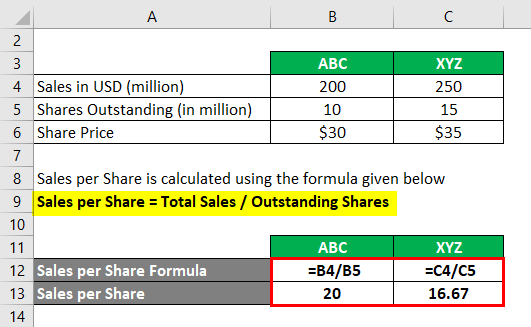

Price To Sales Ratio How To Calculate Price To Sales Ratio Examples

Computing the future dividend value B DPS A.

. The formula used for the average growth rate over time method is to divide the present value by the past value multiply to the 1N power and then subtract one. Smart Technology for Confident Trading. Average down calculator will give you the average cost for average down or average up.

- Total you will have to pay to purchase shares D NSB C. Following is how you would do the calculation assuming the commission fee is 0. NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission.

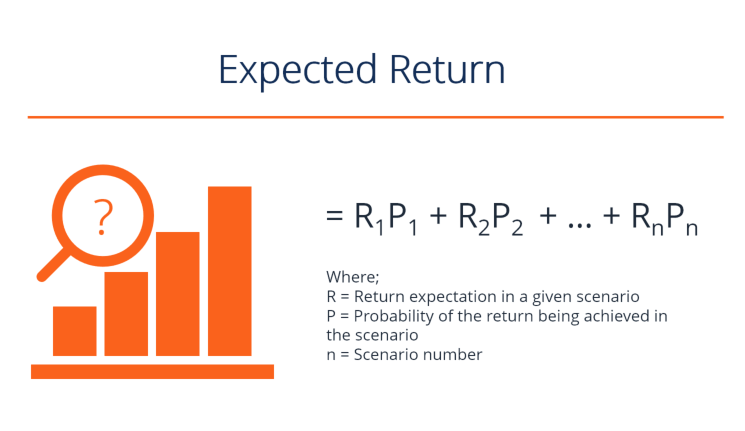

How to calculate the price of a stock. Calculating the rate of return for XYG is as follows. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate.

P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. It means the stock is expected to grow at a rate of 448 per annum. Ad Join 500k Active Members Who Follow Our Free Penny Stock Picks.

Future pricecurrent price1 years 1. Backed By 30 Years Of Experience. If you purchase the same stock multiple times enter each transaction separately.

For example if you purchase 100 shares of a stock at a price of 5 and sold it for 6 your profit will be 100. Take the percentage total return you found in the previous step written as a decimal and add 1. Ownership Percentage of Mark Number of common stocks owned by Mark Total number of Outstanding shares 100.

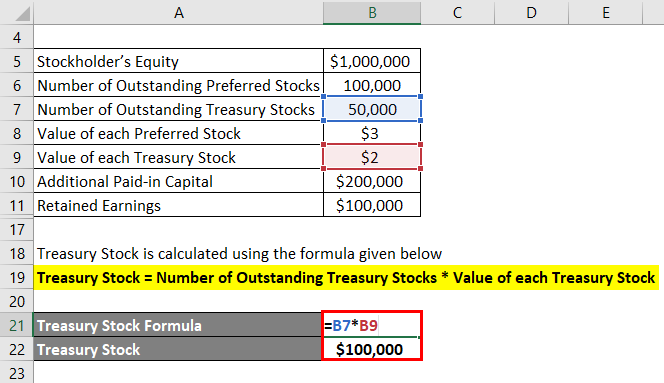

Stock Turnover Ratio is calculated using the formula given below. Divide that total cost by the average of your inventory. Profit P SP NS - SC - BP NS BC Where.

For a company the cost of goods sold ie COGS is a yardstick for the production costs of services and goods. Average Inventory 4341 billion. For example if you brought 100 stocks of company A rate of 10 per stock and bought 200 stocks rate 15 per stock and so on.

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. Use this formula for growth rate calculation. Multiply by 100 to get the.

In the second case 200 multiply with 15 and call 3000 and so on. The average stock needs to be computed as firms might carry lower or higher stock levels at. Penny Stock Traders Have Made Huge Profits.

Take the value of the stock at the beginning of the year and subtract it from the value at the end of the year to find the difference in value. Multiply the rate of increase by 100 to convert it to a percentage increase. Future pricecurrent price1 years 1.

To get an accurate values just add the initial and final inventory of the specific time period and then divide it by two. In the first case 100 multiply with 10 and get 1000. Enter every trade with confidence backed by automated analysis.

Ad Explore the Latest Features Tools to Become a More Strategic Trader. Calculating the Estimated stock purchase price that would be acceptable C B DRR001 SGR001 Then the following indicators are computed. Ad Proprietary system adjusts for any symbol in any asset class with unmatched precision.

Finishing the example multiply 008 by 100 to get an 8-percent increase in stock value. Total Profit or Loss Total Buy Price - Total Sell Price. The Stock Calculator is very simple to use.

Typically annually but it can also be half-yearly or quarterly. Year 2 value year 1 value 1. Keep in mind that equity is not just comprised of common stocks.

Your estimated annual interest rate. Use this formula for growth rate calculation. Then raise this to the power of 1 divided by the number of years you held the investment.

Range of interest rates above and below. Total Sell Price 100 6 600. To calculate the annual dividend growth rate for example you will need to compare the dividend payment from one year to the next using the following formula.

Substituting the values in the formula we get 33000500000100 66 Therefore Mark owns roughly 7 of XYZ. You can work out your average by counting the amount of products that are usually held in the warehouse during the unsold period of time. The Stock Calculator uses the following basic formula.

It is important to calculate your safety stock carefully because while too little stock will result in shortages too much stock will inflate your inventory costs. Average Inventory 4305 billion 4378 billion 2. The average stock formula below shows you how to calculate.

Finding the growth factor A 1 SGR001. Total Buy Price 100 5 500. Stock average calculator calculates the average cost of your stocks when you purchase the same stock multiple times.

Formula for Rate of Return. Average Inventory Inventory at Beginning of the Year Inventory at End of the Year 2. P D 1 r g where.

It can be calculated using the below steps.

Expected Return How To Calculate A Portfolio S Expected Return

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

6 Best Safety Stock Formulas On Excel Abcsupplychain

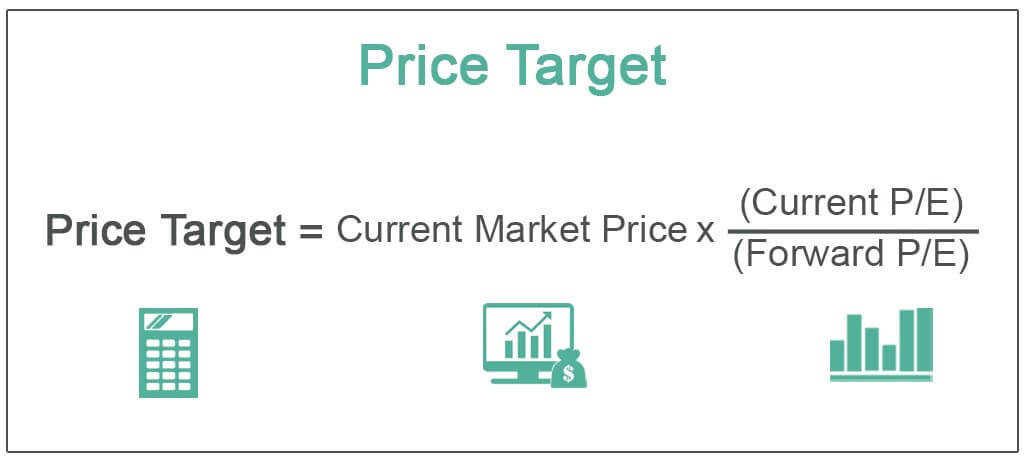

Price Target Definition Formula Calculate Stocks Price Target

How To Calculate Future Expected Stock Price The Motley Fool

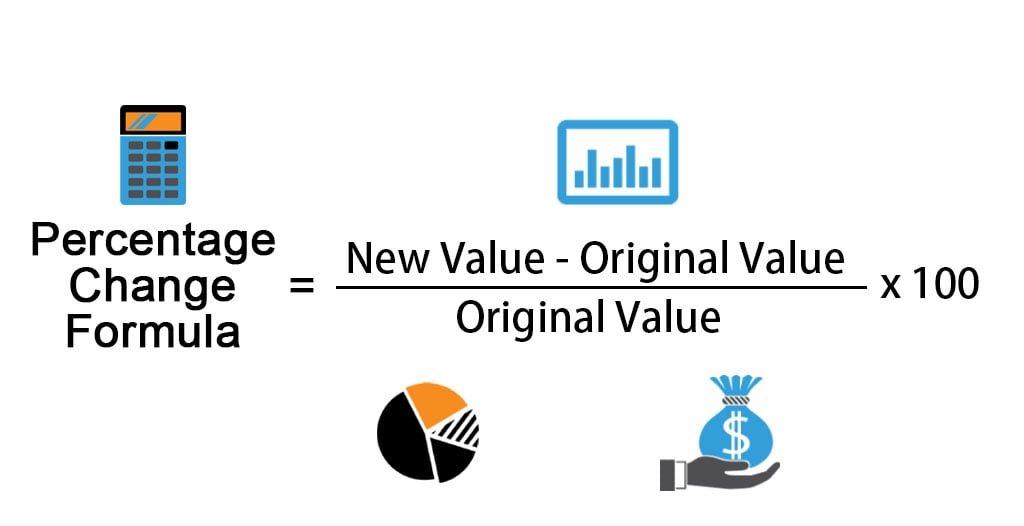

Percentage Change Formula Calculator Example With Excel Template

How To Calculate Future Expected Stock Price The Motley Fool

Common Stock Formula Calculator Examples With Excel Template

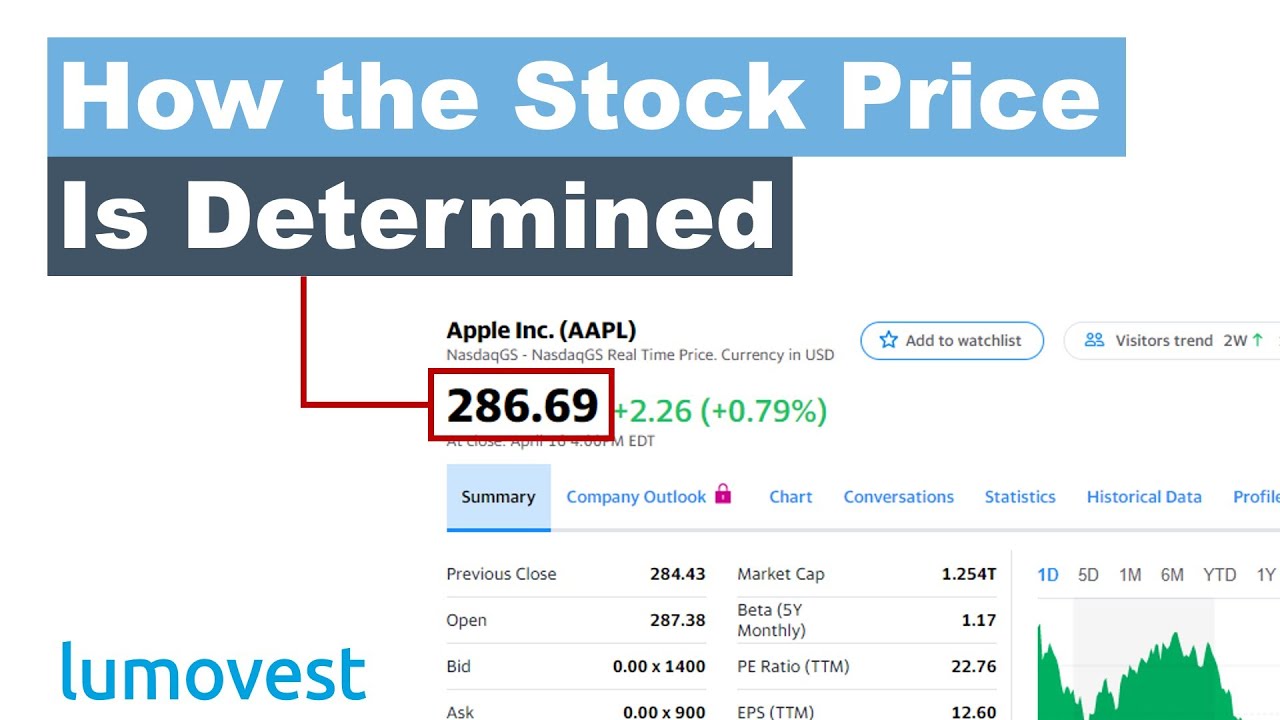

How Is The Stock Price Determined Stock Market For Beginners Part 1 Lumovest Youtube

How To Calculate Weighted Average Price Per Share Fox Business

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Rate Of Return Formula Calculator Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Discount Rate Formula How To Calculate Discount Rate With Examples

Common Stock Formula Calculator Examples With Excel Template

Price Earnings Ratio Formula Examples And Guide To P E Ratio

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

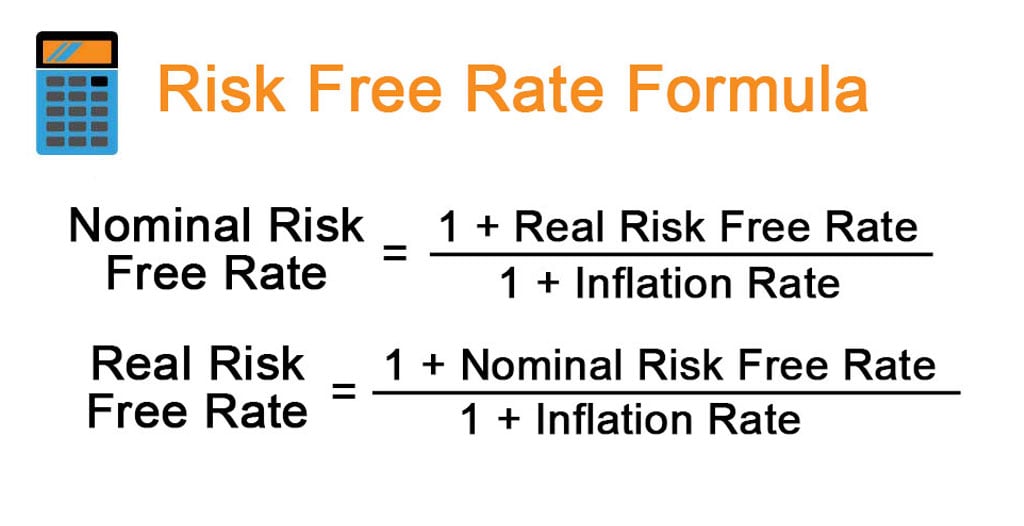

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples