irs unemployment income tax refund

If the exclusion adjustment results in an overpayment refund how will it be issued to me. If the IRS has your banking information on file youll receive your refund via direct deposit.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The unemployment tax refund is only for those filing individually.

. They dont need to file an amended tax return. The IRS identified over 10 million taxpayers who filed their tax returns prior to the American Rescue Plan of 2021. While it is possible to collect benefits as taxable income there are some restrictions according to.

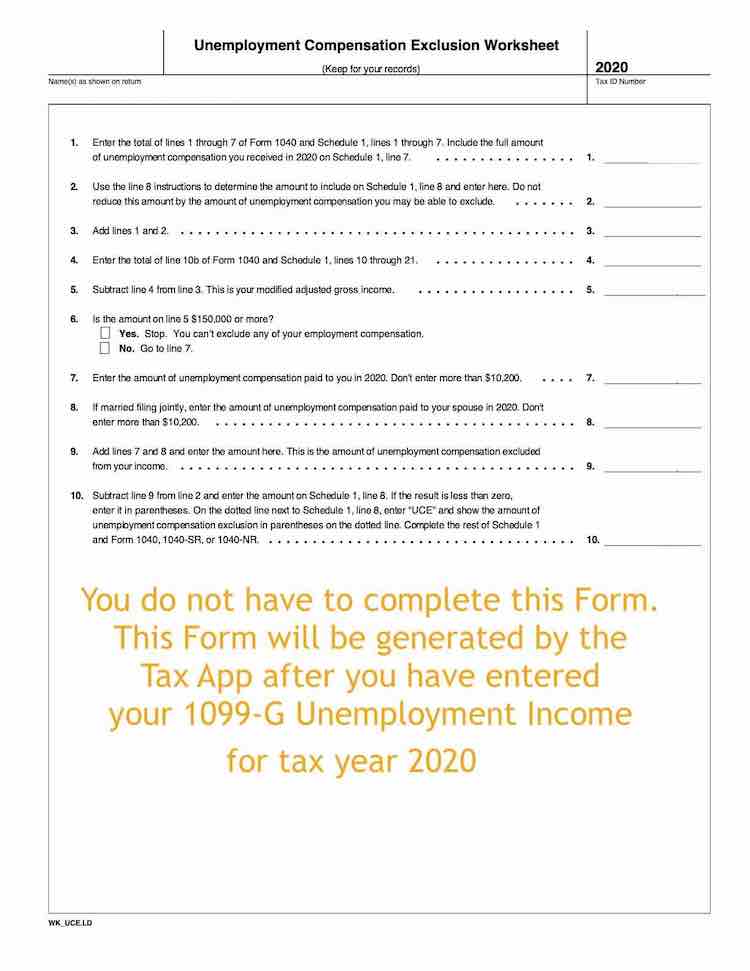

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF. IRS to recalculate taxes on unemployment benefits. According to the IRS the average refund is 1686.

The American Rescue Plan also adjusted the eligibility requirements for the Earned Income Tax Credit which means that more taxpayers may qualify. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns.

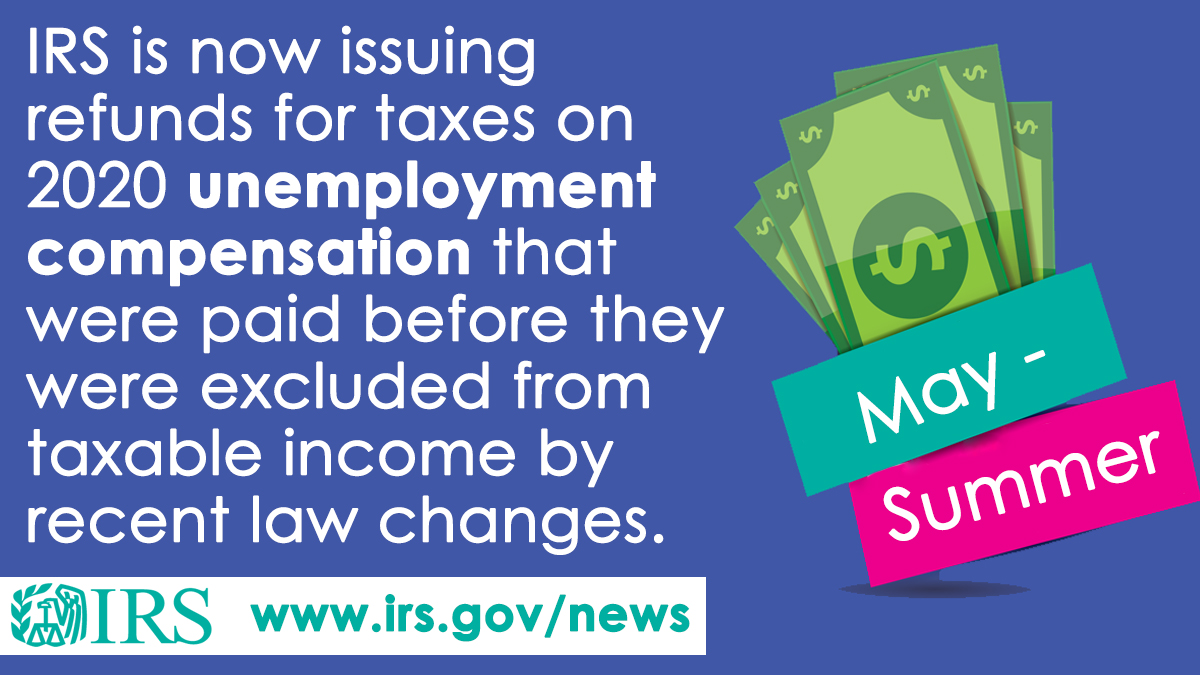

WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income. If you paid more than the correct tax amount the IRS will either refund the overpayment or apply it to other outstanding taxes owed or other debts. The Internal Revenue Service is delivering a fourth round.

The first10200 in benefit income is free of federal income tax per legislation passed in March. The refunds totaled more than 510 million. Added April 29 2021 A2.

24 hours after e-filing. Otherwise youll receive a paper check. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

As of July 28 the last time the agency provided an update more than 10 billion. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment. However there are a few cases where filing an amended return may make sense.

Per the American Rescue Plan up to 10200 of unemployment compensation paid in 2020 is excluded from income meaning that you do. This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

The American Rescue Plan Act enacted on March 11 allows taxpayers with modified adjusted gross income MAGI of less than 150000 on their tax return to exclude unemployment compensation up to 20400 if married filing jointly if both spouses received unemployment benefits and 10200 for all others but only for 2020 unemployment benefits. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American.

Report unemployment income to the IRS. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. State Income Tax Range. The IRS said this spring and summer that it would automatically adjust the tax returns for people who hadnt taken the 10200 exclusion into account when filing and would issue refunds in most cases although some would be required to file amended tax returns.

Check For The Latest Updates And Resources Throughout The Tax Season. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. However the exclusion could result in an overpayment refund of the tax paid on the amount of excluded unemployment compensation.

The IRS is starting to send money to people who fall in this categorywith more refunds slated to. The IRS will automatically recalculate the tax you owe and issue a refund if you overpaid your unemployment income tax. IR-2021-71 March 31 2021.

You will receive back a percentage of the federal taxes withheld based on. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. There are some exceptions though.

The exclusion from gross income is not a refundable tax credit. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. IR-2021-159 July 28 2021.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Is unemployment income excluded from tax. Get your refund faster this year How to collect unemployment benefits as taxable income.

You do not need to take any action if you file for unemployment and qualify for the adjustment. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form. Thousands of taxpayers may still be waiting for a tax refund on unemployment benefits collected during the Covid pandemic as the IRS grapples with a backlog of tax returns. See How Long It Could Take Your 2021 State Tax Refund.

Unemployment claims are now less than what they were before the pandemic. IR-2021-111 May 14 2021. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today.

Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment. These refunds are expected to begin in May and continue into the summer. If youre due a refund from your tax return you should wait to get it before filing Form 1040-X to amend your original tax return.

2020 the unemployment rate has reached its lowest point at 39. Dont file a second tax return. If you received unemployment benefits last yearyou may be eligible for a refund from the IRS.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. All of the federal taxes withheld will be reported on the 2021 return as a tax payment. If you get more than 10 youll receive Form 1099-INT from the IRS and youll need to report the interest on your 2022 federal income tax return.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Unemployment Income and State Tax Returns. The American Rescue Plan Act a pandemic relief law waived federal tax on up to 10200 of unemployment benefits a person collected in 2020 a year in which the unemployment rate climbed higher than any time since.

Refunds to start in May. This story was originally featured on Fortune. Ad File unemployment tax return.

Benefit Overpayment Collection Section. In the latest batch of refunds announced in November however the average was 1189. In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax.

Its taking us more than 21 days and up to 90 to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax Credit. The IRS recently issued 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

Irs Unemployment Refunds Moneyunder30

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

1099 G Unemployment Compensation 1099g

Interesting Update On The Unemployment Refund R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Confused About Unemployment Tax Refund Question In Comments R Irs

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff